no risks and investments

Traders can be divided into three groups: gamers, systems analysts and planners.

Hello dear friends! First things first. Let me congratulate you on Joyful Easter and wish everyone happiness, peace, and God’s grace! I do hope that global geopolitical tensions will eventually fade and people will shrug off fears, anticipating tomorrow with confidence. I wish influential people stopped asserting their military power and did not expose life of civilians to dangers. May fluctuations of trading instruments depend entirely on fundamental data which can be predicted by means of technical analysis regardless of a stance of policymakers who throw markets into turmoil.

The long-awaited presidential election in the US is just 10 days away and tensions between nominees are mounting. Each side tries to strengthen its positions and shake the opponent, sometimes resorting to dirty political tricks. In particular, the FBI announced Friday that it will expand its investigation into Democratic candidate Hillary Clinton’s personal server use. If the FBI does find some criminal wrongdoing, political uncertainty in the US will rise affecting the greenback.

It’s been three months already since David Cameron resigned as the UK Prime Minister. His resignation was triggered by Britain’s vote to leave the European Union and the following 20% slump in the national currency. The funny thing is that Cameron himself was the catalyst forBrexit, using it to threaten the EU and make verbal interventions. And, as far as I can see, new Premier Theresa May decided not to reinvent a wheel and instead adopted Cameron’s ways of manipulating the GBP/USD dynamic.

Dear colleagues, please be aware ofhigher volatility for most trading instruments from Wednesday September 21, 2016. Policy meetings of three central banks are main market movers in the nearest two days. Tomorrow morning, the Bank of Japan is due to post the monetary policy statement. Later, the US Federal Reserve is to announce a rate decision. Analysts assume there is a slim chance (12%) that the US regulator will raise the funds rate. So traders are alert to a speech by the US Fed Chair. Market participants will be looking for clues from Janet Yellen about a timing of rate hikes, which will determine a medium-term trend for the US dollar.

The pound volatility remains high. In the Asian session alone, when trading tends to be relatively muted, price action of the GBP/USD pair currently covers 100-200 pips. Just recently (before Brexit), the Cable’s trading range spanned around 20-30 pips. Tonight was no exception as the British pound strengthened by 1% (145 pips) against the US dollar amid low liquidity. Resistance at 1.3480 capped further gains, and now the pair is edging lower.

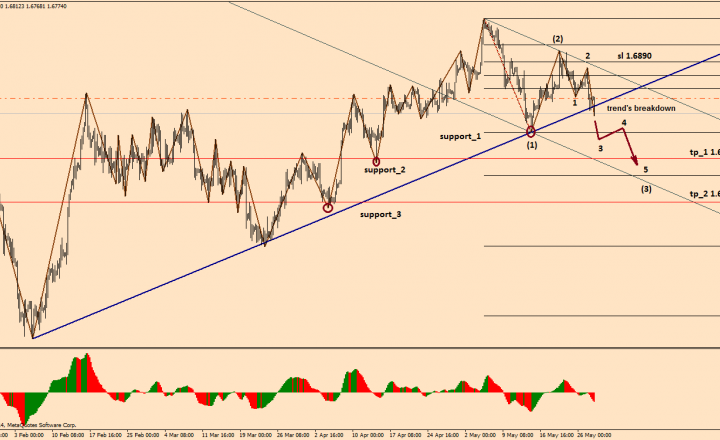

According to the analysis made on May 20, 2014, the GBP/USD pair has the biggest correction. At present, we can see formation of the bearish wave 3 of (3). Pay attention to the break of the trend line H4 and development of the bearish channel. On the chart below you can see my expectations concerning further movement of the pair.

Euro bulls pulled off a strategic victory during yesterday’s New York session. Unfortunately, my shorts were stopped out at 1.3580. Considering the volume around the 1.3535-1.3550 sell zone, we can definitely forget about selling for now.

You can clearly see on the chart loads of positions accumulating from 1.3480. Yesterday the price skyrocketed from that level. During Draghi’s speech, I viewed the rally as a race for stops promising a potential downtrend resumption. However, the volume around the sell level suggests a high probability of a near-term end of the downtrend. What we should do now is to wave goodbye to the slice of profit taken away by the market and go with the flow once again.

You can’t succeed on Forex without sharpening your professional skills constantly. To improve your qualification, keep a trading diary analyzing your deals. The diary could be a simple notebook, a text document in your computer or a print screen with notes saved in any graphic editor.

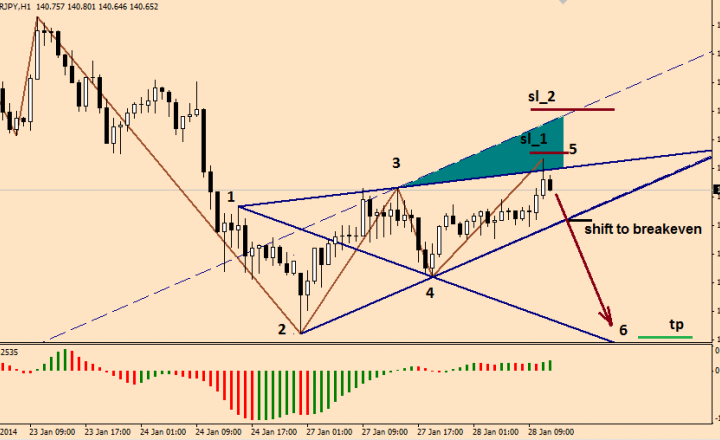

For example, let’s analyze an entry in EURJPY made on Tuesday. A Wolfe Wave was formed on the H1 time frame: